Unlocking New Value in eFX

Raiffeisen Bank International (RBI) significantly improves internalization & inventory management by using ingenium’s advanced eFX Trading solution.

As a prominent bank operating in Central and Eastern Europe they achieved substantial enhancements in its internalization processes and profitability – on a Profit per Million (PPM) level – in their eFX Spot business within 18 months of adopting ingenium. This case study illustrates how RBI effectively utilized ingenium’s sophisticated analytics, advanced risk management, and smart auto hedger tools to optimize its trading flows and markedly boost profitability.

The Challenge

RBI faced the common challenge of balancing profitability and risk within its eFX trading operations. To achieve sustainable growth, the bank required deeper insights into flow quality, actionable data for effective decision making, automation to enhance inventory and skew management, as well as implement smart execution strategies. Moreover, RBI aimed to address the risk associated with basic price aggregation during the price creation process, particularly in relation to skew leakage.

Step 1

Data Collection

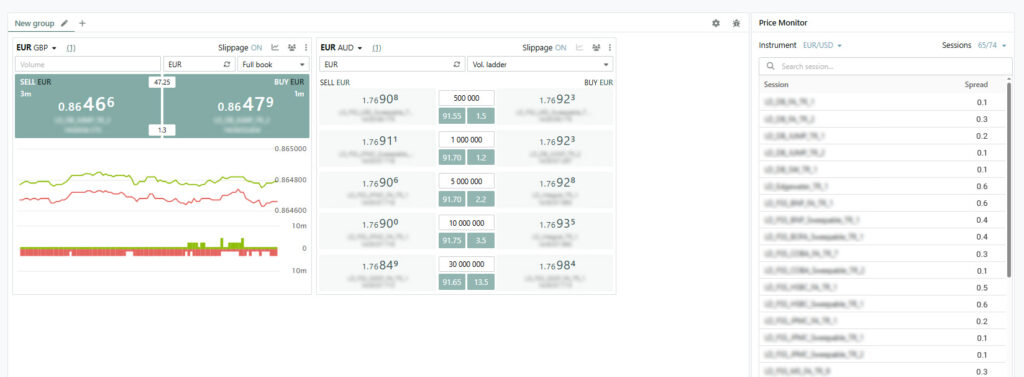

Due to mixed feedback from LPs related to market impact when using LPs pricing in basic price aggregation, RBI created a new unique core FX Spot price, establishing a reliable ultra-low latency price source for multiple ccy pairs in its eFX Spot business. This initiative effectively separated the pricing sources for price-making (Reference View) from the liquidity streams employed in its hedging activities (Hedge View).

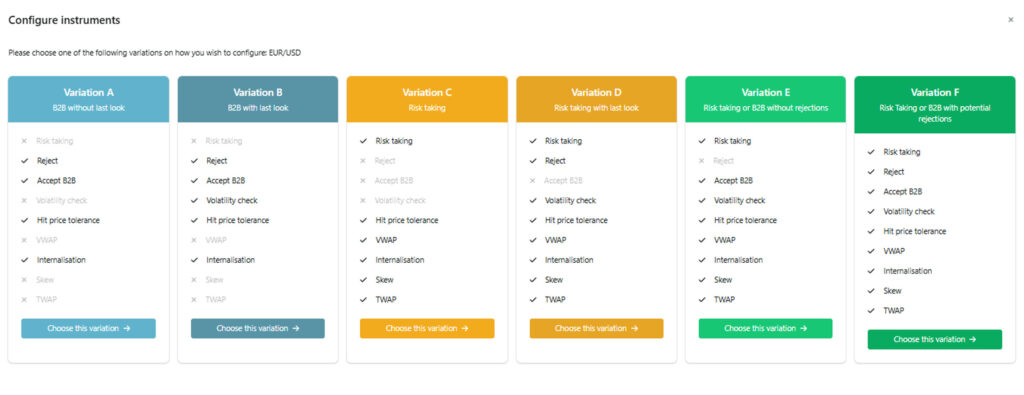

Data Collection via a mixed Risk taking & B2B model. RBI began implementing Variation E (see graphic „ingenium configurations“). In this setup, RBI operated in a mixed risk & B2B mode with some Volatility Check parameter, meaning:

- Partial Risk taking & B2B: Trades were executed based on RBI’s existing risk or B2B mode for the respective FX Spot flow on a customer tag level.

- Discretionary pricing: RBI utilized its unique core FX spot price alongside internalization mode and standardized skew mode.

- Status Quo Transparency: This model accurately documented the existing conditions, but it did not incorporate a data-driven methodology to tailor customer tag settings at the currency pair level based on customer behaviour. While this approach carried moderate risk, it also meant RBI’s profit potential was constrained. However, it provided a crucial first step: collecting granular trading data through ingenium. This data did later serve as the foundation for deeper analysis and smarter optimization.

Step 2

Understanding Flow Quality with ingenium Markout Explorer

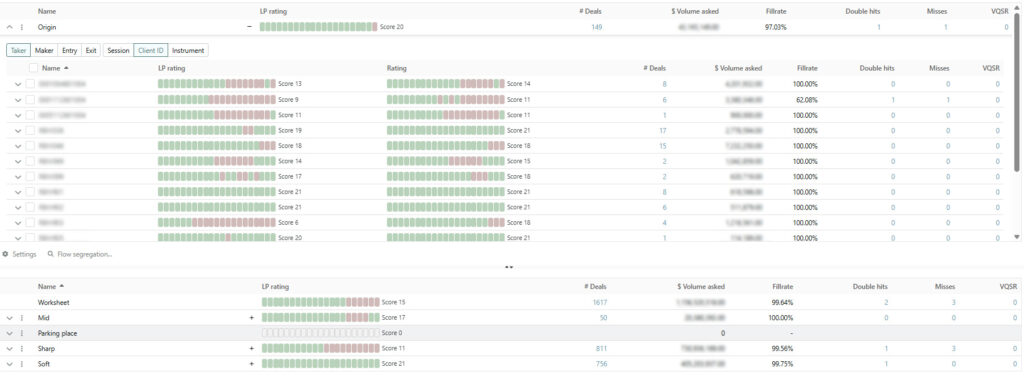

With data flowing in, RBI turned to ingenium Markout Explorer tool. This powerful module enabled RBI to:

- Segment flows using fully customizable markout profiles. While standard categories such as “soft,” “mid,” “sharp,” and “unknown” are available, ingenium Markout Explorer offers flexibility to define and adapt profiles tailored to specific business needs.

- Isolate toxic vs. benign flows. By examining how client trades perform, RBI could distinguish between flows that typically moved the market adversely and those that were more passive or neutral.

- Manage incomplete data. The “unknown” category captures client flows with insufficient historical data, allowing RBI to handle uncertainty systematically rather than ignoring it.

Step 3

Historical Analysis Using ingeniums Risk Explorer

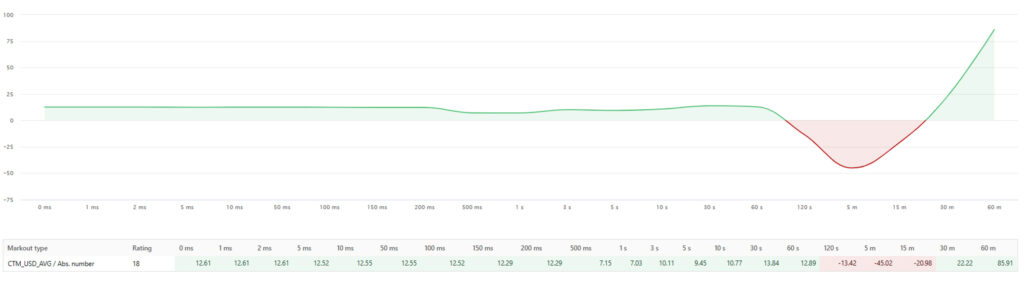

After analysing their flow segments, RBI wanted to explore whether selectively taking risk on certain flows- i.e. such as specific clients or instruments within the “soft flow” category could boost profitability beyond a standard B2B model.

However, configuring parameters for risk-taking – i.e. Take Profit, Stop Loss etc, can be complex and carries significant financial implications if set incorrectly. That is where ingenium Risk Explorer was utilized.

Risk Explorer is an embedded back testing engine within the ingenium system that allows users to:

- Leverage historical data. The Risk Explorer uses the clients dedicated market data at the time of each order and simulates trading based on the client‘s liquidity profile. The tool simulates trading outcomes based on past market conditions and actual flow patterns.

- Run multiple iterations. The user then defines boundaries for key parameters, and the Risk Explorer uses Machine Learning to systematically test thousands of scenarios to discover optimal configurations.

- Identify robust strategies. By comparing outcomes across different setups, RBI could pinpoint rule sets that maximize profitability while keeping risk exposure under control.

Step 4

Implementing Optimized Strategies in inventory & skewing management

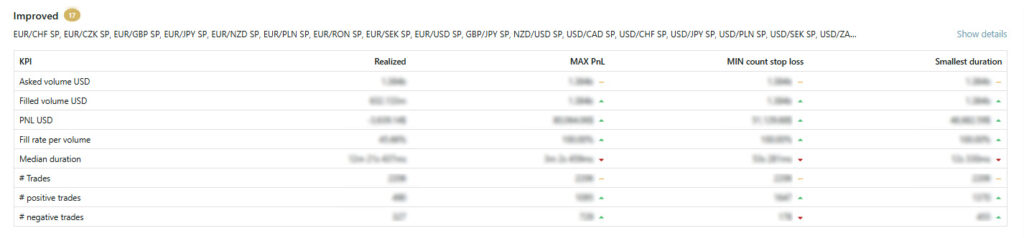

Based on recommendations from ingenium’s Risk Explorer, RBI was ready to transition from a “gut feeling”, on what flow should be treated in what manner and towards a sophisticated data driven risk-taking approach for their eFX Spot business. They implemented the optimal configurations identified into their live trading environment and enabled the advanced skewing capabilities on their Making streams to boost internalization.

At this stage, the combination of internalization and ingenium’s smart auto hedger used when aggressing the market, allowed for seamless executions of these new strategies. The smart auto hedger enables users to:

- Automate risk management. It dynamically monitors positions and applies hedging logic based on pre-set parameters.

- Risk management aligned with new profitability goals. The smart auto hedger ensures that all risk taking is consistent with the firm’s objectives and desired profitability targets.

- Maintain safety nets. Even when taking on calculated risk, automatic safeguards prevent excessive losses, protecting PNL.

By integrating the optimized rules into the smart auto hedger in combination with the skewing configuration, RBI achieved a highly efficient, automated execution framework. This not only removed manual intervention but also provided confidence that risk was being managed according to the bank’s strategic objectives.

The Results

Thanks to this structured, data-driven approach:

- ingenium‘s advanced eFX Trading Solution transforms Raiffeisen Bank International’s eFX Spot Market Making Activities.

- The integration of ingenium’s advanced analytics and tools provided RBI with deeper insights into flow quality and trading performance, enabling more informed and data-driven decision-making.

- RBI significantly improved its internalization ratio and the profitability in the eFX Spot business within 18 months.

- RBI improved the communication towards counterparties with detailed markout analytics & spread comparison reports.

This success story demonstrates how ingenium can transform trading operations by combining granular analytics, smart risk tools, and seamless automation.