Analyzing Profitability for Asset Managers

At ingenium, we empower our clients to maximize returns and minimize costs with our cutting-edge Execution Toolkit.

This case study showcases production results, demonstrating how our tools transform trading performance and drive significant profitability. By leveraging advanced execution strategies, our clients achieve reduced market impact and substantially more profitable execution.

The Power of the Execution Toolkit

The ingenium Execution Toolkit is designed to optimize trade execution, slash costs and flatten markout curves. Lower execution costs translate directly into higher profitability. To illustrate this, we analyzed order flow for two major currency pairs, EUR/USD and USD/JPY on order flow of trades done with sizes of 5m or more. Below, we will compare the performance with and without the Execution Toolkit.

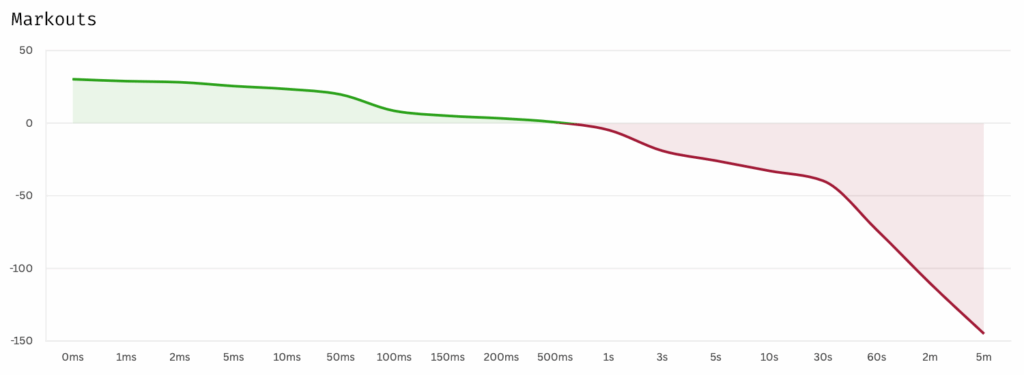

WITHOUT the Execution Toolkit

EUR/USD

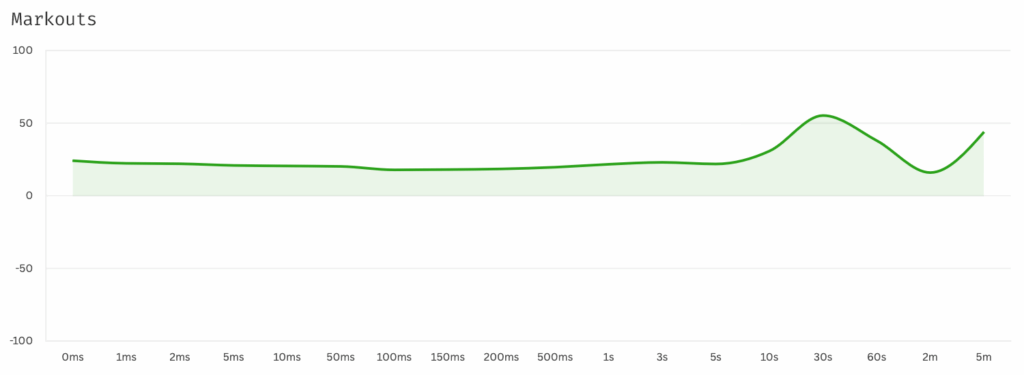

WITH the Execution Toolkit

EUR/USD

| EUR/USD (without Execution Toolkit) | EUR/USD (with Execution Toolkit) | |

|---|---|---|

| PNL | $(791.27) | $31,193.63 |

| PPM | $(0.19) | $33.68 |

| Filled Vol USD | 4,065,744,612.00 | 926,168,752.50 |

WITHOUT the Execution Toolkit

USD/JPY

WITH the Execution Toolkit

USD/JPY

| USD/JPY (without Execution Toolkit) | USD/JPY (with Execution Toolkit) | |

|---|---|---|

| PNL | $19,126.52 | $45,965.70 |

| PPM | $4.82 | $47.65 |

| Filled Vol USD | 3,968,354,987.52 | 964,741,531.04 |

When comparing the two different sets of order flow, you can see ingenium’s Execution Toolkit has materially led to increased profitability and decreased market impact.

Profitability in USD/JPY increased roughly 10x and EUR/USD by 30x.

Why It Works?

The ingenium Execution Toolkit delivers superior trading outcomes through core functions designed to optimize performance:

- It analyzes market volatility to pinpoint the most advantageous times to execute trades, ensuring optimal entry and exit points.

- It identifies and capitalizes on uniquely competitive quotes, securing pricing that maximizes trader value.

- It leverages market movements to enhance profitability, turning favorable trends into tangible gains.

Collectively, these capabilities reduce execution costs and drive consistent, efficient results.

Unlocked Trading Potential with ingenium

The ingenium Execution Toolkit delivers transformative results for multiple client types, but especially Asset Managers. By slashing execution costs and boosting profitability, ingenium empowers users to stay ahead in competitive markets.